200 day MA going above 50 day on rising volume and down trend.

febSee's gabble

Friday, May 28, 2010

Thursday, May 27, 2010

Copper Futures retesting the 200 day EMA

Demand of copper from China dwindling? Copper futures are resting the 200 day EMA again. After the flash crash a while ago, copper futures are indicating that we have entered bear market territory.

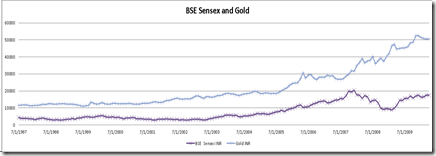

BSE Sensex and Gold

I tried to plot the performance of BSE Sensex with respect to the price of Gold. Since Gold has been increasing for the past twenty odd years, and can be considered a measure of inflation, the rise in the stock markets are partly attributed to inflation (essentially the value of INR keeps dropping as Gold increases).

The first chart shows the performance of the Sensex since 1997 till now alongside performance of Gold.

If one measures the value of the Sensex in terms of Gold, you will find that the Sensex is not that high:

Between the periods of 1997 to 2001 (approx.) the Sensex had a near perfect correlation with the price of Gold. Essentially the stock market was pricing in inflation and not necessarily growth. This was when financial reform started by Dr. Manmohan Singh in 1991 gave the country good GDP growth, the returns on the stock market in real terms (Gold) was not significant.

Notice this starts changing after 2001 and Gold starts exploding.

If you subtract the values of Sensex and Sensex in Gold, you get the divergence. Notice how the graph explodes after 2001 or so.

Some of this ramp-up seen after 2001 are attributed to the Federal Reserve loosening monetary policy after the dot-com bubble and 9/11. With the interest rates being kept at very low levels in US, money started finding its way into more riskier assets like Stocks and emerging markets (Brazil, Russia, India, China – BRIC).

Here is the chart of the Federal Funds rate since 1954. Federal funds rate. Note that we are at historic lows. There is only one way for this rate to go. Once it starts ramping up, a lot of things are going to start unwinding. The bubble in Gold now will probably get pricked once we have the rates going up.

Things which tend to go up with interest rates going up: Value of USD, Mortgage interest rates, Savings Bank Account Interest (US), US Bond yields (I think)

Things which tend to go down with interest rate hike: Emerging market stocks, value of US bonds, Gold, precious metals etc.

Note that the argument about returns on the Sensex have not accommodated dividend yields.

Data Sources:

http://www.federalreserve.gov/releases/h15/data/Monthly/H15_FF_O.txt

http://in.finance.yahoo.com/q/hp?s=^BSESN&g=m&a=00&b=1&c=1971&d=04&e=27&f=j